You should already know the Candlestick Analysis basics covered in the Forex Education section. If you have not gone through the Candlestick Analysis basics please do so as it is important to understand the basics before learning this strategy.

Current Price Analysis (The Second Half)

When trading Price Action current data is always more important than old data. This is because what is happening NOW is always more important than what happened a few hours ago.

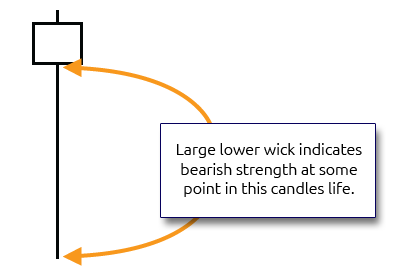

To put this into perspective let’s look at a 4 hour candle.

This candle has a few distinctive features. A long lower wick, a bullish body, and a small upper wick. So let’s break this candle down. For the first half of this candle’s life it headed in a bearish direction. We can see this from the long lower wick. So it is safe to assume that for a period of this candle’s life the Bears were in control.

Close to the end of this candle’s life, the Bulls took control of price. We can see this by the bullish body and the fact that we have a long lower wick. The long lower wick tells us that the Bears had control to start with, but the Bulls took control before the candle closed.

This is where the term ‘the second half’ comes from. For the first half of this candle’s life the Bears had control, but for the second half the Bulls had control.

What happens in the second half of a candle’s life is always more significant to us. When the Bulls take control in the second half of a candle, they will probably continue to have control when the next candle opens.

This alone is not enough to base a trade on. However, it is a very important piece of Price Action Analysis.

Please note that ‘the second half’ is a generalization. It could very well be that the bullish move in the candle above came in the last 5 minutes. The point I am trying to get across is that recent data is more important. You need to use candles to analyze who is currently controlling the market.

Long Wicked Patterns

Now that you understand the second half, I am going to show you the strongest type of reversal pattern and show you why it is so strong.

A Long Wicked Pattern has two parts

- The Preceding Trend.

- The Indecision Candle.

The Preceding Trend: A strong trend which indicates that the Bulls or the Bears are currently in control of the market. Generally, in Long Wicked Patterns a trend should consist of four or more candles and the candles should be moving strongly in the same direction. In other words, it should be very clear that either the Bulls or the Bears are in control of the market.

Take a look at the candles above. The first set shows clearly defined bullish control of the market. The second set also shows bullish control, however, it shows a weak control of the market. The move is almost sideways and the Bulls are clearly not gaining any ground. So remember, you want to see a clear and strong control of the market from either the Bulls or Bears.

Identifying a preceding trend is not hard, but it is also not a science. I can’t tell you “a trend is exactly 100 pips,” because a trend is dependent on current market conditions and the currency pair you are trading. I know it is a little hard when you do not have an exact rule to follow, but with just a little practice you will be able to spot trends with ease. If you keep an eye on my blog you will be able to see the trades I take and, from that, you will learn how to spot the best preceding trends.

The Indecision Candle: Indicates that the Bulls or Bears are losing power. The Indecision Candle has three main features:

- The wick must be longer than the body of the candle.

- The wick must be pointing in the same direction as the preceding trend.

- The body of the candle should be opposite to the preceding trend.

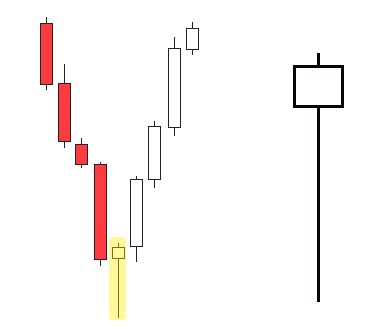

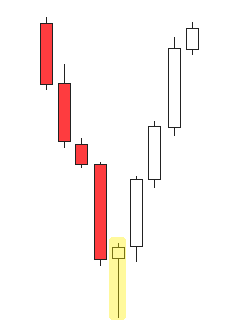

Above, I explained the concept of ‘the second half’ and I showed you an Indecision Candle. Now I am going to put that in the context of a Long Wicked Pattern.

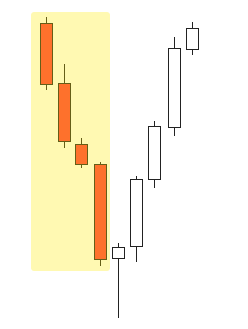

In the yellow highlighted box, you can see the bearish preceding trend. Looking at these candles it is very clear what they tell us. Both the first and second half of each of the candles tell us that the Bears are in control of the market. The little lower wick tell us the Bulls are fighting back but the strong bearish bodies tell us that the Bears are dominating.

In the yellow highlighted box, you can see the Indecision Candle. This candle indicates something totally different. It tells us that for the first half the bearish strength continued and the price moved down quite a bit. However, the second half of the candle shows us some very significant bullish movement. It shows us that the Bulls were so strong that they were able to completely reverse the bearish movement and close the candle with a bullish body.

Think about the significance of this. The market changed from being completely dominated by the Bears to indecision and then bullish power. The second half of the Indecision Candle tells us that the Bulls are taking control and that the bullish power might continue in the next candle.

That is a Long Wicked Pattern in a nutshell. Now please do not get overexcited and start trading these patterns. You need to understand reversal trades before you can enter a trade.